Indexing Protects Gains

We’ve already explored how indexing works: If an underlying index goes up you get corresponding interest credited to your account subject to whatever provisions your policy lays out. The underlying index goes down you get at worst zero or no interest credited to your account for the period.

Most of us remember the market in late 2008. How many of us would have been ecstatic to take a zero on our retirement accounts that year?

What about less dramatic market swings or an up & down (“sideways” ) market?

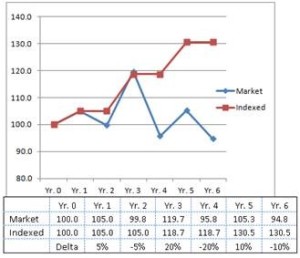

Consider an example where the underlying index (or market) goes up 5%, down 5%, up 20%, down 20%, up 10% then down 10%. At the end of 6 years the underlying index would be down 5.5% (if it started at 100 it would then be 94.5).

Consider an indexed strategy with a 13% cap that over the same time period would lock in a 5% gain after year 1, return zero (but not lose) in year 2, lock in 13% (capped) in year 3, return zero (but not lose) in year 4, lock in a 10% gain in year 5 and return zero (but not lose) in year 6. At the end of 6 years this strategy would return 30.5%.

(example assumes no transaction costs, costs of insurance etc. meant only to demonstrate a concept)